Why Your Payment Gateway is Key to Ecommerce Success

A Shopify payment gateway is the technology that securely processes customer payments on your online store, connecting your business with your customers’ wallets. Without a reliable payment gateway, your ecommerce business simply cannot function.

Quick Answer for Shopify Payment Gateway Options:

- Shopify Payments – Built-in solution with no extra transaction fees

- Stripe – Developer-friendly with advanced features (2.9% + 30¢)

- PayPal – Trusted brand recognition (2.59% + fixed fee)

- Square – Great for omnichannel selling (2.6% + 10¢)

- Authorize.net – Reliable for recurring billing ($25/month + fees)

Your choice of payment gateway directly impacts three critical aspects of your business: customer trust, conversion rates, and your bottom line. A smooth checkout experience can make or break a sale, while a clunky payment process sends customers straight to your competitors.

The numbers don’t lie. Shopify checkout converts 15% better on average than other solutions, and consumers increasingly lean toward online shopping. This means your payment gateway isn’t just a technical requirement – it’s a competitive advantage.

Cart abandonment remains one of the biggest challenges in ecommerce. When customers hit roadblocks during payment, they simply leave. The right gateway eliminates friction, builds confidence, and turns browsers into buyers.

Security is non-negotiable. Your payment gateway must protect sensitive customer data while meeting strict compliance standards like PCI DSS. Any security breach can destroy years of reputation building overnight.

I’m Cesar A Beltran, founder and CEO of Blackbelt Commerce, and I’ve spent over 15 years helping businesses optimize their Shopify payment gateway integrations and checkout processes. Through working with 1000+ ecommerce businesses, I’ve seen how the right payment gateway choice can dramatically impact conversion rates and customer satisfaction.

Find more about Shopify payment gateway:

How Payment Gateways Work & What to Look For

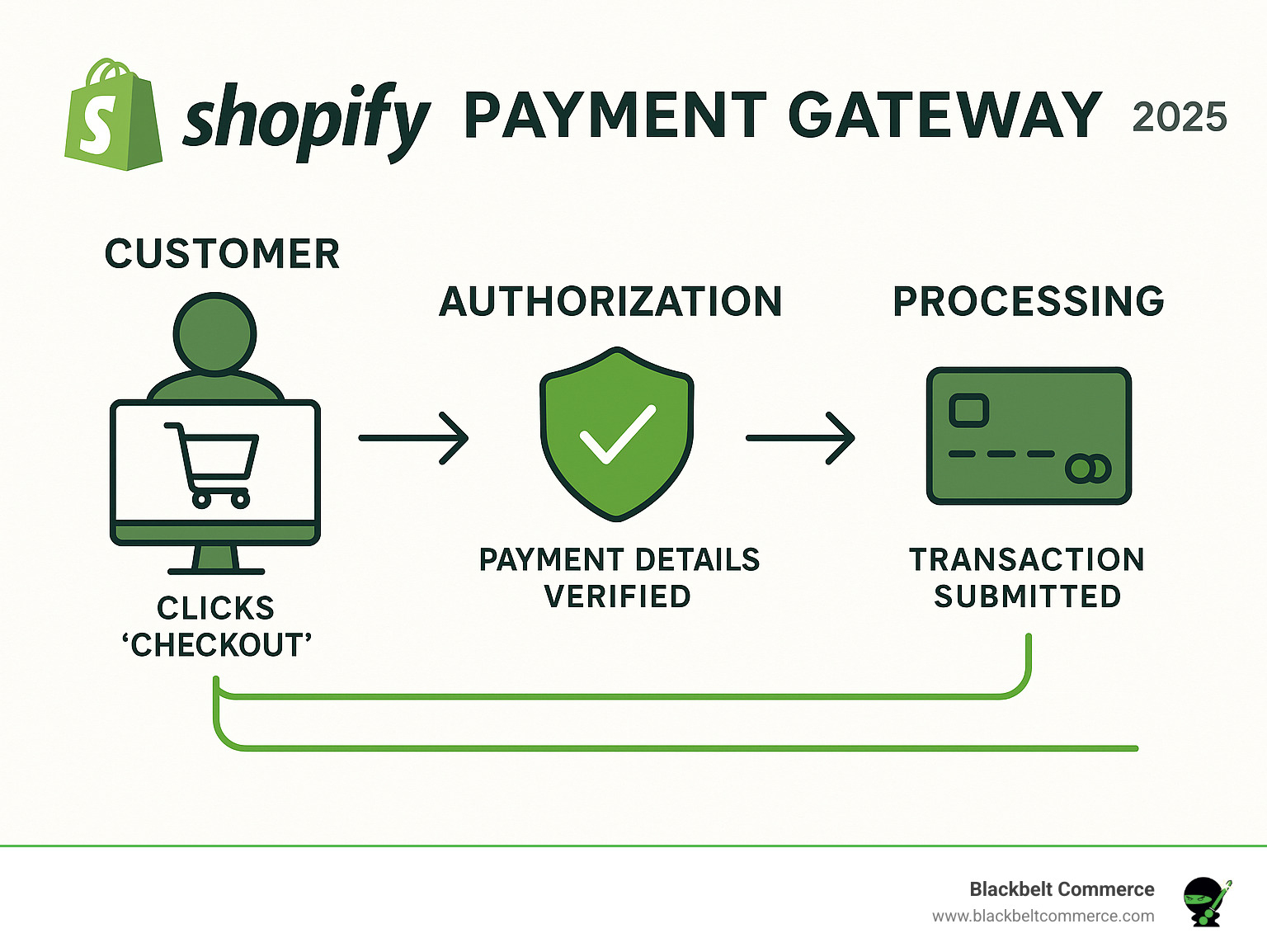

Picture this: a customer finds the perfect product on your Shopify store, adds it to their cart, and clicks “buy now.” What happens next is like a carefully choreographed dance between multiple financial systems, all happening in seconds.

Your Shopify payment gateway acts as the digital bridge between your store and the banking world. It’s essentially the online version of those card readers you see in physical stores, but much more sophisticated.

Here’s how the magic happens behind the scenes. When your customer enters their payment details and hits submit, the gateway instantly encrypts that sensitive information and shoots it over to the payment processor. Think of this like putting the payment info in a digital safe before sending it anywhere.

The processor then knocks on the door of your customer’s bank, asking “Hey, does Sarah have enough money for this purchase?” The bank checks the account, makes sure the card isn’t stolen, and sends back either a thumbs up or thumbs down.

This approval or denial travels back through the same chain – from the bank to the processor to your gateway, and finally to your Shopify store. If everything checks out, your customer sees that satisfying “Order confirmed!” message.

But we’re not done yet. At the end of each business day, all those approved transactions get bundled together and sent for settlement. This is when the actual money moves from your customers’ accounts into your business account, usually taking a few business days to complete.

Now, here’s something that trips up a lot of store owners: the difference between a payment gateway and a payment method. Your payment method is what your customer uses to pay – their Visa card, PayPal account, or Apple Pay. The payment gateway is the how – the technology that actually processes whatever method they choose.

When it comes to gateway types, you’ve got three main flavors. Hosted gateways send customers to a separate page to enter their payment info, then bring them back to your store. It’s like sending them to a secure bank teller. Self-hosted gateways let customers stay on your site but still handle the heavy lifting behind the scenes. API-hosted gateways offer the smoothest experience, keeping everything seamlessly integrated on your store without any redirects.

Key Features to Look for in a Shopify Payment Gateway

Choosing your Shopify payment gateway isn’t just a technical decision – it’s a business strategy that affects everything from your profit margins to customer satisfaction. Let me walk you through what really matters.

Security and PCI compliance should be your absolute top priority. Your gateway needs bulletproof encryption, tokenization, and multi-factor authentication. More importantly, it must meet PCI DSS standards – think of this as the gold standard for handling credit card data safely. The good news? Shopify itself maintains Level 1 PCI compliance (the highest level), so you’re already ahead of the game. Still, your gateway choice matters, especially when it comes to robust fraud protection features that shield you from costly chargebacks.

Transaction fees directly hit your bottom line, so pay close attention here. Every gateway charges differently – some use percentage-plus-fixed-fee models, others offer blended rates, and many add monthly or setup fees on top. Don’t just look at the advertised rate; calculate the total cost based on your expected transaction volume and average order value.

Payment method variety can make or break your conversion rates. Your gateway should handle all the basics like Visa, Mastercard, and American Express, but also accept the digital wallet revolution with Apple Pay, Google Pay, and Shop Pay. Don’t forget about PayPal, Buy Now Pay Later options like Klarna and Afterpay, and even cryptocurrency if your customers want it. The more ways people can pay, the fewer abandoned carts you’ll see.

International support and multi-currency handling becomes crucial if you’re thinking globally. Your customers want to see prices in their local currency and pay without currency conversion surprises. Look for gateways that support dozens of currencies and handle the conversion transparently. Shopify Payments supports over 135 local currencies, making international expansion much smoother.

Integration simplicity saves you time and headaches. Shopify Payments wins here with its built-in setup, but third-party options should offer clear documentation and straightforward installation. The easier it is to get running, the faster you can focus on what really matters – growing your business.

Customer support quality often gets overlooked until you desperately need it. When payment issues arise (and they will), you need responsive support that actually solves problems. Look for 24/7 availability, multiple contact options, and a track record of helpful service. Trust me, you’ll appreciate this when a payment glitch threatens to cost you sales.

The Showdown: Shopify Payments vs. Top Third-Party Providers

Here’s where things get interesting. Shopify gives you incredible flexibility with over 100 payment providers to choose from globally. While this variety is fantastic, it also means you need to understand the cost implications of your choice.

If you don’t use Shopify Payments as your primary gateway, Shopify adds an extra transaction fee on top of whatever your chosen provider charges. These fees aren’t small either – 2% on Basic Shopify, 1% on Shopify, and 0.5% on Advanced Shopify. However, Shopify Plus merchants get a sweet deal: use Shopify Payments as your primary gateway, and these transaction fees disappear for all other payment methods you offer.

This fee structure makes your gateway choice a critical business decision that directly impacts your bottom line. Let’s break down your top options.

Shopify Payments: The Built-in Solution

Think of Shopify Payments as the native language of your Shopify store. Launched in 2013, it’s automatically ready to go when you set up your store – no separate merchant accounts, no complex integrations, no headaches.

The biggest win with Shopify Payments is eliminating those extra transaction fees entirely. When you process payments through Shopify Payments, Shop Pay, Shop Pay Installments, or even PayPal Express, you won’t pay Shopify’s additional fees. For high-volume stores, this savings alone can be substantial.

But the benefits go deeper than just cost savings. Shop Pay, Shopify’s accelerated checkout, comes built-in and offers a game-changing customer experience. With over 27 million shoppers already using Shop Pay in EMEA alone, customers can complete purchases with just one tap. The conversion boost is real – we’ve seen 5% higher conversion rates even when Shop Pay isn’t used, and up to 50% improvement when customers do use it.

The fraud protection deserves special mention. Shopify Payments leverages insights from over 10 billion transactions to protect your store with AI-powered fraud analysis that’s more sophisticated than basic third-party tools.

For international selling, Shopify Payments supports over 135 local currencies, making it seamless for customers worldwide to shop in their preferred currency. Everything – payouts, refunds, chargebacks, reporting – lives right in your Shopify admin.

However, Shopify Payments isn’t available everywhere. Currently, it’s supported in 23 countries, and certain business types are prohibited due to regulatory restrictions. If you’re outside these parameters, you’ll need to look elsewhere.

Stripe: The Developer’s Choice

Stripe has earned its reputation as the developer’s dream payment gateway. If you need advanced customization or complex payment flows, Stripe delivers with powerful APIs and extensive documentation.

What sets Stripe apart is its comprehensive product suite that goes far beyond basic payment processing. Need subscription billing? Stripe handles complex recurring payments beautifully. Want marketplace functionality? They’ve got you covered. Their Radar fraud detection uses machine learning to protect your business from fraudulent transactions.

Stripe’s global reach is impressive – 135+ currencies across 47 countries – making it excellent for international businesses. With Stripe Terminal, you can also accept in-person payments, creating a true omnichannel experience.

The pricing is straightforward: 2.9% + $0.30 per online transaction, with additional fees for international cards (1.5%) and currency conversion (1%). You’ll also pay Shopify’s transaction fees on top of this unless you’re on Advanced Shopify or higher.

PayPal: The Trusted Household Name

PayPal brings something money can’t buy: instant customer trust. With millions of users worldwide, offering PayPal often increases conversion rates simply because customers feel more secure using a service they already know and trust.

The One Touch feature keeps customers logged in for faster checkouts, reducing friction at the crucial moment of purchase. PayPal’s global reach spans over 200 countries and 25 currencies, making it particularly valuable for international sales.

For small businesses just starting out, PayPal is often the easiest gateway to set up and manage. The fees typically start at 2.59% + a fixed fee, though rates can vary based on your business profile and volume.

We’ve written detailed guides on PayPal vs Other Gateways on Shopify: When to Switch? and How to Reduce PayPal Fees if you want to dive deeper.

Other Notable Gateways

Several other excellent options might be perfect for specific business needs:

Authorize.net is the reliable workhorse of payment gateways. It’s been around forever and excels at recurring billing with comprehensive fraud management tools. Expect to pay around $25 monthly plus 2.9% + $0.30 per transaction.

Square shines for omnichannel businesses that sell both online and in-person. Their unified inventory and sales reporting across all channels makes life much simpler. Online fees run about 2.6% + $0.10 per transaction.

Adyen targets enterprise-level businesses with high transaction volumes. They focus heavily on mobile optimization and offer real-time analytics with excellent authorization rates. Pricing typically involves a fixed processing fee (€0.11) plus fees per payment method.

Braintree, owned by PayPal, offers exceptional flexibility for complex payment needs. It handles credit cards, PayPal, Venmo, and digital wallets seamlessly. Fees generally run 2.59% + $0.49 per transaction.

| Feature / Gateway | Shopify Payments | Stripe | PayPal |

|---|---|---|---|

| Fees (Online) | Varies by plan (e.g., 2.9% + 30¢ Basic) – no Shopify transaction fees | 2.9% + 30¢ | 2.59% + fixed fee |

| Supported Countries | 23 countries | 47 countries | 200+ countries |

| Key Advantage | Built-in, no Shopify transaction fees, Shop Pay | Developer-friendly, advanced features, global reach | High brand recognition, ease of use for consumers |

| Best For | All Shopify stores, especially those valuing simplicity and conversion | Growing businesses, SaaS, marketplaces, high-volume | Small businesses, leveraging customer trust, international sales |

| Fraud Prevention | Exclusive, AI-powered | Radar (machine learning) | Seller Protection (limited) |

| Payout Speed | Typically 2-4 business days | Typically 2-7 business days | Typically 1-3 business days |

Choosing the Right Shopify Payment Gateway and Optimizing Costs

Picking the perfect Shopify payment gateway is like choosing the right foundation for your house – it needs to support everything you’re building on top of it. There’s no universal “best” choice because what works brilliantly for a local boutique might be completely wrong for a global enterprise.

After helping over 1,000 businesses optimize their payment setups, I’ve learned that the right gateway choice comes down to understanding your specific situation and matching it with the right features.

Factors to Consider for Your Business

Let me walk you through the key questions we ask every client when selecting their ideal payment solution:

Where is your business located? This isn’t just about preference – it’s about what’s legally available to you. Shopify Payments only operates in 23 countries currently, so if you’re based elsewhere, you’ll need to explore third-party options from day one.

Where do your customers live? If you’re selling to customers in Germany, they expect to see prices in euros and pay with SEPA. If you’re targeting customers in Japan, they might prefer convenience store payments or bank transfers. Your gateway needs to speak your customers’ payment language.

How much are you selling? A startup processing $1,000 monthly has very different needs than an enterprise doing $100,000 daily. High-volume merchants can often negotiate better rates, while smaller businesses need to focus on gateways with low fixed costs.

What type of business are you running? Some industries face higher scrutiny from payment processors. If you’re selling supplements, digital downloads, or operating in what’s considered a “high-risk” category, your options might be more limited and fees higher. It’s not fair, but it’s reality.

How fast are you planning to grow? Starting with a simple solution is fine, but make sure it can handle your future plans. If you’re eyeing international expansion or planning to add subscription products, choose a gateway that can grow with you rather than forcing a painful migration later.

How to Reduce Your Payment Processing Costs

Payment fees can feel like death by a thousand cuts, especially when you’re watching your margins. Here’s how to keep more money in your pocket:

The Shopify Payments advantage is hard to ignore. When you use it as your primary gateway, Shopify waives those pesky additional transaction fees that otherwise range from 0.5% to 2% depending on your plan. For most merchants, this single decision saves more money than any other optimization.

Volume gives you negotiating power. Once you’re processing serious volume – think millions annually – payment processors become much more flexible. Stripe, PayPal, and others often have enterprise programs with reduced rates. The worst they can say is no, so always ask.

Your Shopify plan matters more than you think. Yes, higher plans cost more monthly, but they offer lower credit card rates and reduced third-party gateway fees. We’ve seen businesses save thousands annually by upgrading their plan, even after accounting for the higher monthly cost.

Better conversion rates effectively lower your payment costs. If you can convert 3% of visitors instead of 2%, you’re getting 50% more sales from the same traffic and marketing spend. Optimizing your checkout experience is like getting a discount on every transaction. Check out our guide on checkout optimization for specific tactics.

Prevent chargebacks like your profits depend on it – because they do. Beyond the lost sale, chargebacks come with fees ranging from $15 to $100 each. Use your gateway’s fraud protection tools, write clear product descriptions, and provide stellar customer service to avoid these costly reversals.

How to set up your Shopify payment gateway

Setting up your chosen Shopify payment gateway is thankfully much easier than choosing it. Shopify’s interface is designed to make this process as painless as possible.

Start by logging into your Shopify admin and navigating to Settings > Payments. This is your payment command center where you’ll manage everything.

For Shopify Payments, look for the “Activate Shopify Payments” button if you haven’t set it up yet. The activation process is straightforward – you’ll provide your business details, bank account information, and verify your identity. Shopify guides you through each step, and most merchants complete this in under 10 minutes.

Adding third-party providers is equally simple. Scroll down to find “Choose a provider” or “Add payment methods.” Shopify shows you all available options for your location, so you won’t waste time on incompatible gateways.

When you select a provider like PayPal or Stripe, you’ll either connect an existing account or create a new one. This usually involves copying API keys or going through a secure authorization process. Each provider includes step-by-step instructions specific to Shopify integration.

Don’t forget to enable additional payment methods like Shop Pay, Apple Pay, and Google Pay in the same settings area. These accelerated checkout options can significantly boost your conversion rates with minimal setup effort.

Finally, configure your payout schedule if you’re using Shopify Payments, or manage payouts through your third-party provider’s dashboard. You can always log in to explore payment options and make adjustments as your business evolves.

The beauty of Shopify’s system is that you can manage multiple payment providers from one central location, making it easy to test different options and optimize your setup over time.

Frequently Asked Questions about Shopify Payment Gateways

After helping over 1,000 businesses optimize their Shopify payment gateway setups, we’ve noticed the same questions come up repeatedly. Here are the answers that matter most to your business success.

Can I use more than one payment gateway on Shopify?

Absolutely! In fact, I strongly recommend it. Think of multiple payment gateways like having different doors into your store – the more options you provide, the easier it is for customers to complete their purchase.

Your typical setup might include Shopify Payments handling most credit card transactions and Shop Pay, while PayPal serves customers who prefer that trusted brand name. You could also add a Buy Now, Pay Later option like Klarna or Afterpay to capture younger shoppers who love flexible payment terms.

Here’s the financial reality though: while Shopify Payments waives those extra transaction fees, you’ll still pay Shopify’s additional charges on orders processed through other gateways. These fees range from 2% on Basic Shopify down to 0.5% on Advanced Shopify. It’s a balancing act between offering customer choice and managing your costs.

The conversion boost often makes it worthwhile. When customers see their preferred payment method at checkout, they’re much more likely to complete the purchase instead of abandoning their cart.

What happens if my business is not supported by Shopify Payments?

Don’t worry – you’re definitely not stuck. Shopify integrates with over 100 payment providers globally, so you’ll have plenty of options even if Shopify Payments isn’t available in your country or doesn’t support your business type.

Your first step is finding a third-party provider that works in your region and accepts your business category. Popular alternatives include Stripe (available in 47 countries), PayPal (supporting 200+ countries), or regional specialists that understand local payment preferences.

The trade-off is cost. Without Shopify Payments, you’ll pay both the gateway’s processing fees and Shopify’s additional transaction fees on every single order. These extra Shopify fees can add up quickly, so it’s crucial to shop around and compare total costs, not just the advertised rates.

Some businesses in restricted categories actually find that specialized high-risk payment processors offer better support and understanding of their unique needs, even with higher fees.

How do I handle international payments and different currencies?

Going global with payments is easier than you might think, but it requires the right strategy. Your Shopify payment gateway choice makes a huge difference in how smoothly international sales flow.

Shopify Payments supports selling in over 135 local currencies through Shopify Markets. When a customer in Germany visits your store, they can browse and pay in Euros while you still receive funds in your home currency. Shopify handles the conversion automatically, though you’ll pay a currency conversion fee (typically 1.5% in the US, 2% elsewhere).

The customer experience improvement is dramatic. Shoppers are much more likely to buy when they see familiar currency symbols and don’t have to do mental math on exchange rates.

Third-party gateways like Stripe, PayPal, and Adyen also excel at international payments, each with their own conversion rates and global reach. PayPal, for example, operates in over 200 countries and already has the trust of international customers.

Beyond currency, consider local payment methods that customers expect in different regions. Dutch customers love iDEAL, Germans prefer Sofort, and Belgians use Bancontact. Some specialized gateways focus entirely on these regional preferences.

Fraud prevention becomes more critical with international sales. Cross-border transactions naturally carry higher risk, so ensure your chosen gateway has robust tools for analyzing international payments. The last thing you want is to lose money to fraudulent orders while trying to expand globally.

The key is starting simple – pick one or two target markets, understand their payment preferences, and expand gradually as you learn what works for your international customers.

Conclusion: Finalizing Your Payment Strategy

Choosing the right Shopify payment gateway isn’t just another checklist item—it’s a pivotal business decision that directly impacts conversions and customer trust at the moment of purchase.

We’ve explored how gateways operate, the features that matter most—security, fair fees, wide payment-method support, and dependable service—and we compared Shopify Payments with third-party leaders like Stripe and PayPal. Each suits different goals and geographies.

Your ideal gateway hinges on where you sell, who your customers are, and how quickly you expect to scale. Keep costs down by using Shopify Payments when possible, negotiating rates as volume climbs, choosing the right Shopify plan, and reducing chargebacks.

Setup is straightforward: activate Shopify Payments or connect a third-party provider in minutes within the Shopify admin, so you can start accepting payments without delay.

Blackbelt Commerce has guided more than 1,000 merchants through these exact choices. If you’re ready to optimise checkout, integrate advanced features, or expand globally, we’re here to help you build something extraordinary.